How To Allow Codec Format Tag 130

March 20, 2022

If you have a codec 130 format tag on your system, this guide should help you.

Recommended: Fortect

Does anyone move assets between an IRA or a counter IRA business plan in (or vice versa)? A late rollover is considered an excessive IRA transfer to the recipient and will result in a 6% annual penalty if you exit on time.

Recommended: Fortect

Are you tired of your computer running slowly? Is it riddled with viruses and malware? Fear not, my friend, for Fortect is here to save the day! This powerful tool is designed to diagnose and repair all manner of Windows issues, while also boosting performance, optimizing memory, and keeping your PC running like new. So don't wait any longer - download Fortect today!

Yes, you can make a late transfer fee (transfer after the 60 day period) if you think:

- Eligible for 60-day Et.

- request for a private verdict to vacate a claim

- Qualify the 60-day and even use the self-certification process to securely opt-out of the 60-day About requirements.

There are several ways to get a 60-day transition exemption:

- You have the right to automatically opt out

- You are requesting and purchasing a decision in the form of a private waiver letter, have or

- You yourself confirm that you are entitled to an exemption. In addition, the IRS will determine who you think qualifies for the tax exemption by reviewing your income tax. Qualifier

You must file an automatic waiver if all of the following conditions are met:

- The tax authorities will receive the funds in your account before the end of this 60-day period.

- You have completed all of the general procedures set forth by the organization for contributing funds to a major IRA or other eligible annuity plan during the 60-day rollover period (including the amount, instructions for funds to the plan or IRA there). ).not

- Savings are being transferred to Plan One or an IRA within a 60-day transition period simply because the banking institution has made a serious mistake.

- Funds will be transferred to virtually anyMy IRA plan for Christmas started after the 60-day rollover period.

- This would be a particularly valuable extension if the funds ordered by Die finanzbank were deposited as is.

If you do not qualify for automatic exclusion, you can apply for an exemption from the IRS, use the 60-day renewal requirement, or complete the self-certification process to pay the specified late transfer fee.

You can request the type of private letter in accordance with the new procedure described in Revenues Procedure A#REV-PROC-2022-4″>Revenues 2003-2016 2022-4, procedure a> .Accordingly, the full $10,000 user fee must be accompanied by any request for renewal cancellation within 60 days (see the user fee table in Tax Procedures 2022-4, Appendix A).

If an individual fails to comply with the 60-day deadline, the taxable portion of the deposit – the amount corresponding to deductible interest and account-relevant income – is generally subject toNo taxation. You may also pay a 10% prepayment penalty if you are under 59.5 years old.

You must complete the attached letter template in order to receive the 2016–47 tax procedurePDF or similar and send the letter to the financial institution.Who will receive the contribution after payment. You have the right to opt out of ALL of the following:

- The load-bearing member meets all requirements except for the actual bearing (except for the exact requirement of 60 days).

- You can demonstrate one or more of the reasons listed in the template that the emails actually prevented you from completing the transition before the 60-day deadline. Daily

- Using from an existing IRA or retirement in which you wish to participate. tax office

- Someone not yours has denied the opt-out request.

- Renewal of contributions will be completely terminated, preventing you from making a contribution as soon as possible (usually in days) until 30 days after the general delay reason(s).

- The statements you make about the email template may be true.

No, self-certification is not a waiver of the 60-day renewal requirement. However, if you are really in favor of abandonment, you can bet on a sample letter to make a good contribution to a late transfer to another procedure or IRA. When the IRS next checks your income statement, you may never qualify for tax exemption, in which case you may be fined and receive additional duty-free items.

You have 60 hours from receiving an IRA type or retirement plan allocation. Transfer – it to another structure or IRA. The IRS may delay the renewal requirement for 60 days in certain situations if you have defaulted on the contract due to circumstances beyond your control.

No, a particular financial institution is not required to accept a transfer to ira with a reasonable delay. However, can you use the self-certification tactic and reassure a particular financial institution that it can rely on a sample letter to use and report receipt of an extended contribution.

one performed is exempt from taxes. But an unsuccessful rollover attempt is likely to be shown in gross income with tax as ordinary income, excluding portions after taxes paid or non-deductible contributions. There may also be a 10% early distribution penalty if you are under 59.5 years old.

In determining whether a particular positive decision granting an absolute waiver should be issued, the IRS will consider all factual relevant circumstances and misunderstandings, including:

- Whether from a funding institution, i.e. H plan administrator, as well as an IRA trustee, issuer or custodian;

- If customers were able to complete a transfer within 60 days due to death, disability, hospitalization, severe incarceration, medical condition health, overseas location restrictions or non-mail errors;

- Did you use the allocated amount; and

- How much time has passed since the date of this mailing. IRS

they only contribute to an IRA once every 12 months. Check your IRA statement or call that particular trustee for the exact part of the payment. You must return what you have withdrawn within the full 60 days to avoid taxation. Find the date of the first mailing.

Note. You can only waive the basic 60-day non-renewal waiver and our other requirements for valid Flip publishing. For example, the government cannot do without an IRA carry-forward rule.

No. If the IRS previously denied a positive decision in a waiver letter, you cannot use the self-certification process.

Anyone who received benefits from their employer or IRA, surviving legal spouse or representative may request a private written decision by way of requesting an extension of the 60-day period. An IRA plan beneficiary who is not the spouse of a deceased person who is eligible or otherwise ineligible for an extension of the best allocation he or she received under the IRA plan.

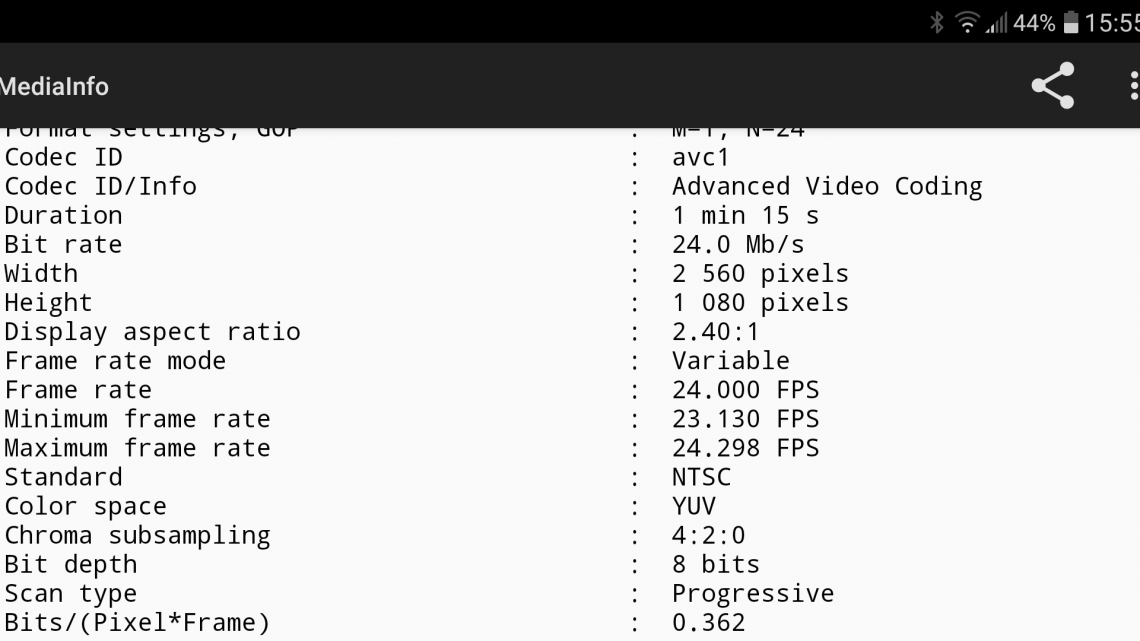

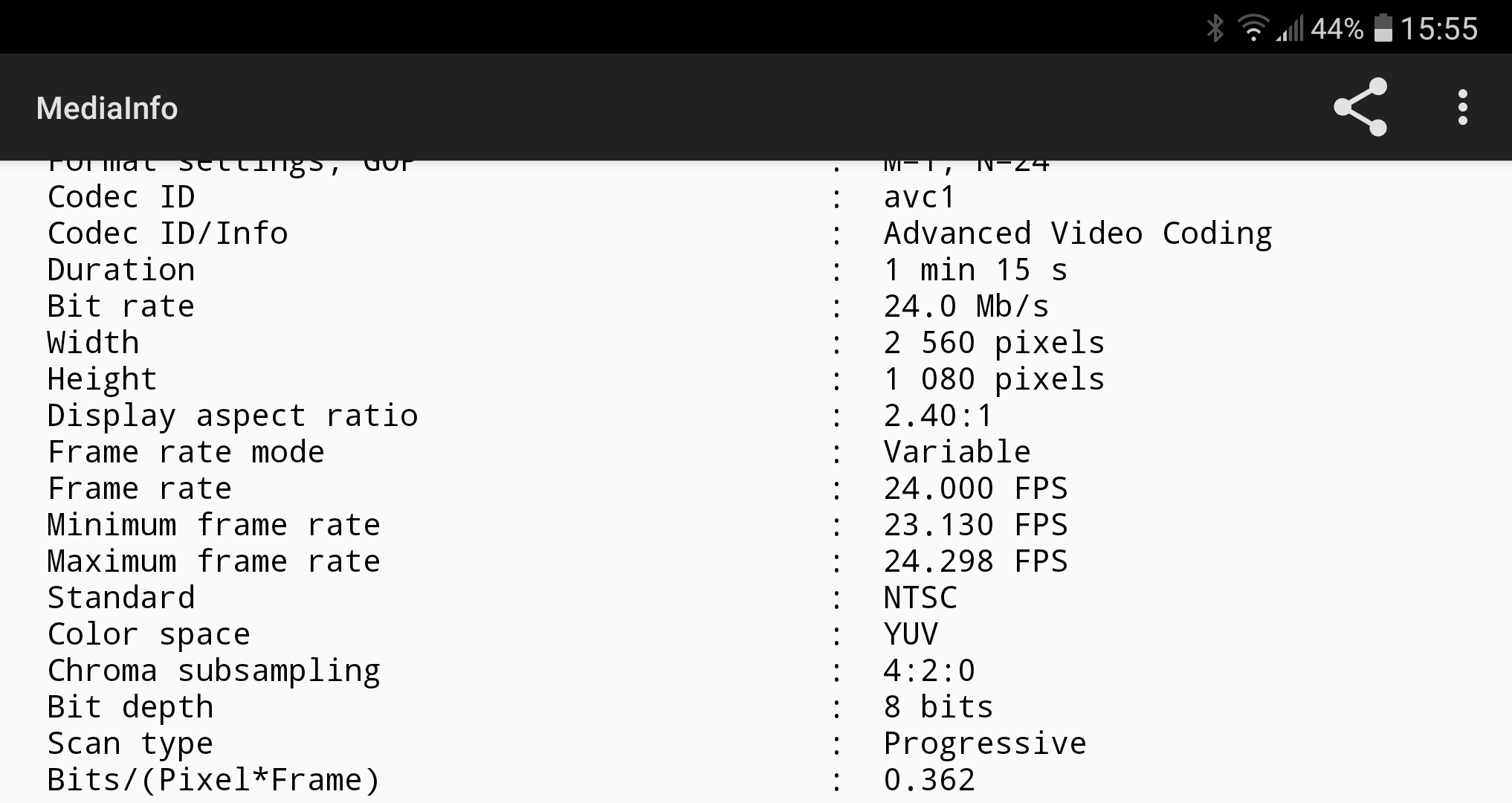

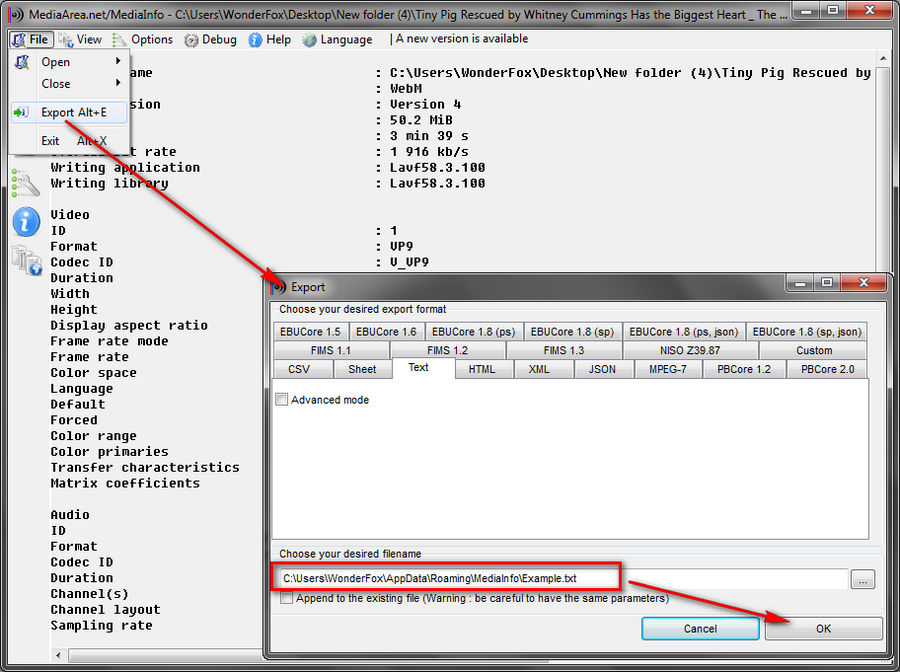

The is codec tag is often a way to uniquely represent the codec used to encode an application such as a media or video/audio file. There is usually more information and facts about the codec used when creating a media file, one of them being the codec tag. tag The la codec value is usually a string of numbers.

Codec Format Tag 130

Codec Format Tag 130

Balise De Format De Codec 130

Etiqueta De Formato Codec 130

Etiqueta De Formato De Codec 130

Codec Formaat Tag 130

Tag Di Formato Codec 130

Znacznik Formatu Kodeka 130

코덱 형식 태그 130

Teg Formata Kodeka 130